If you didn't like your tax refund this year, here's what you should do in 2019 - Good Morning America

What You Need to Know to File Your 2019 Tax Returns | by Lehigh Business | ilLUminate: Lehigh Business Thought Leadership | Medium

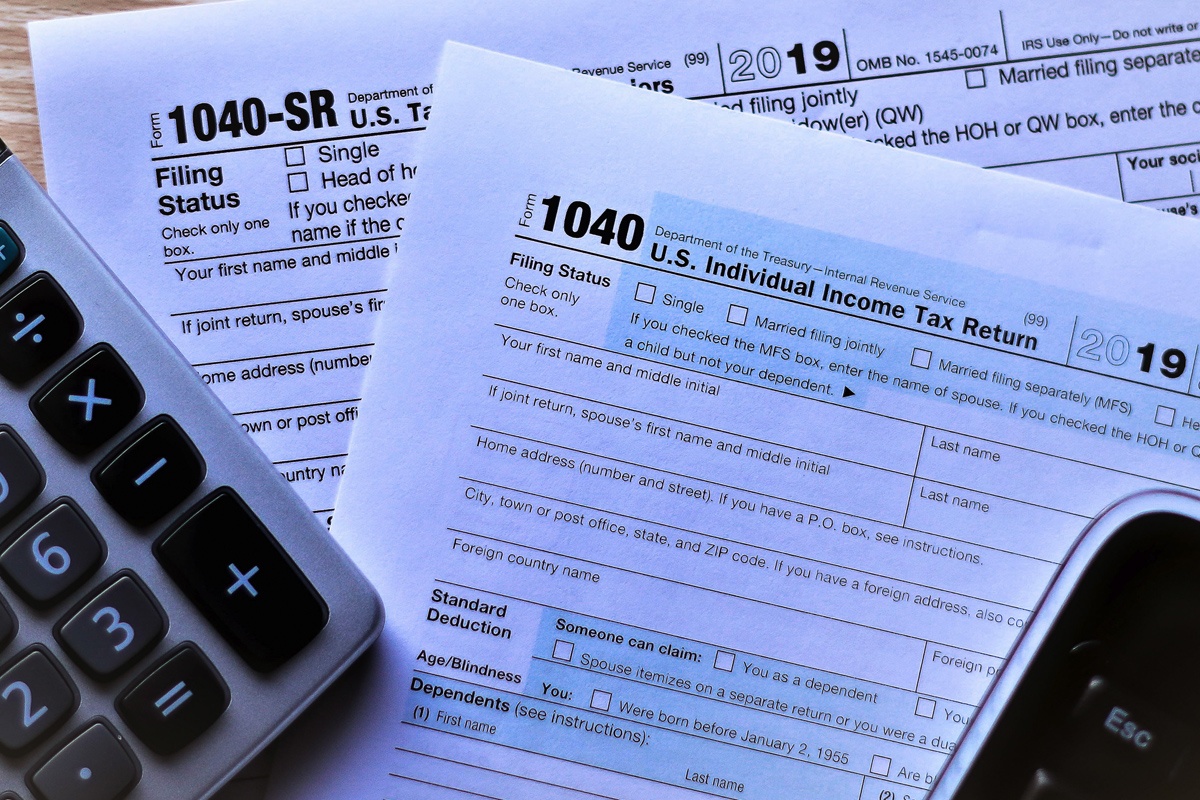

1040 income tax return form 2019 with calculator and pen. Concept of filing taxes, payment, refund, and April 15, 2020 tax deadline Stock Photo | Adobe Stock

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

![Tax Time Is Coming; What's New for 2019 [BOOKLET + CALCULATOR] - WDET 101.9 FM Tax Time Is Coming; What's New for 2019 [BOOKLET + CALCULATOR] - WDET 101.9 FM](https://wdet.org/wp-content/uploads/2018/12/IMG_5575_1.jpg)